The Nordic way of wealth

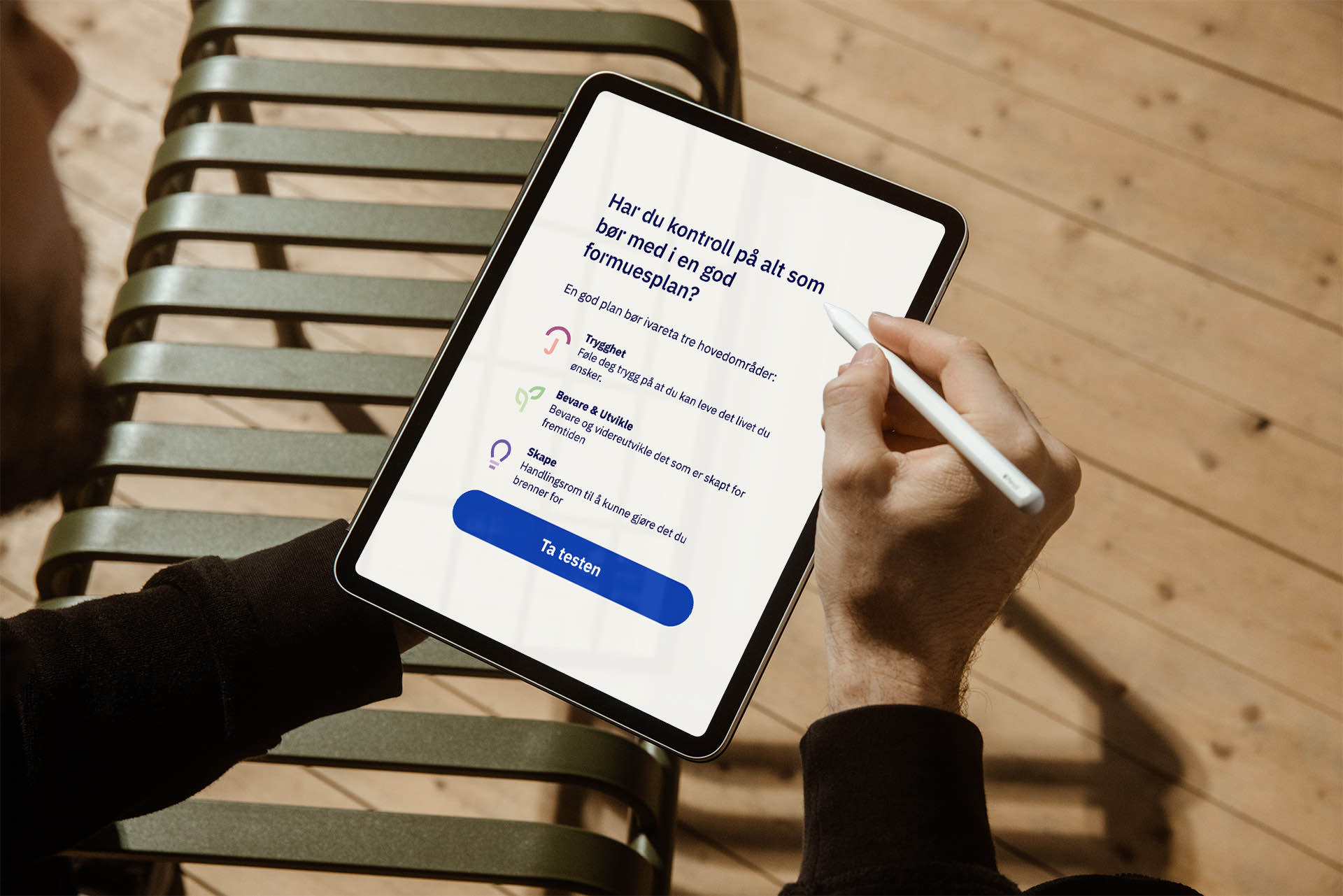

How good control do you have over your fortune?

The first step towards making a good wealth plan is to map areas you should address. We always start our advice by getting to know you and the current situation. By taking our test, we get an overview of your needs and how we can help you gain better overall control. Do you have control over everything that should be included in a good wealth plan?

Our advisory

Managing a large fortune is a demanding task with many pitfalls. Our experienced wealth managers help you to assess your situation in the three following parts –Safety, Preserve & develop and Create – where the goal is to find the right balance.

Your personal wealth plan

Once your situation and your goals with the wealth have been mapped, the wealth plan begins to take shape. With the help of our comprehensive range of services, we provide expert advice in tax, law, inheritance and generational change, as well as pensions when needed. The wealth plan includes a tailored investment plan based on your preferences and what you want to achieve with the wealth. Financial planning does not end when the first plan is made. With our digital wealth plan, you and the advisor have an ongoing tool that you can steer by and easily bring out when needed.

Reporting and follow-up

Through the Wealth app and the customer portal, you always have access to your investment portfolio and your wealth plan. There you can keep track of how sustainable your investments are, as well as which sectors and where in the world your capital is located. Our advisors are an ongoing conversation partner for all the thoughts and questions that may arise along the way around topics that are affected in the wealth plan. At least once a year, you and your advisor review the plan that has been put in place to ensure that it is still in line with your wishes.